- Mortgage Nuggets

- Posts

- Fairway reports cyber attack that exposed customer data nationwide

Fairway reports cyber attack that exposed customer data nationwide

Plus: Rocket to close down origination channel for real estate and insurance agents

👋 Good morning. Welcome to March! Today’s newsletter is 855 words, 3 minutes.

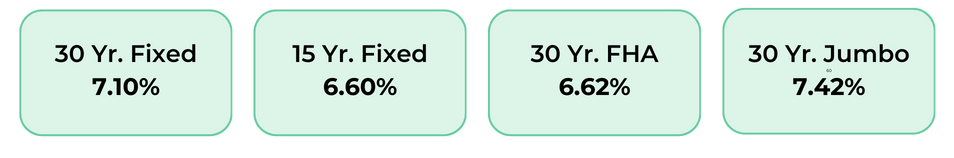

Disclaimer: Average mortgage rates as of Feb 29, 2024. © MND's Daily Rate Index.

1. Rocket to close down origination channel for real estate and insurance agents

Rocket is closing its Rocket Pro Originate business, which sponsors real estate agents and other financial services professionals to help customers obtain mortgages.

The program allowed professionals to sign up as an MLO, with Rocket providing training. Sponsored LOs can work in 39 states, while mortgage brokers could work with Rocket Pro Originate in 11 states.

The last day for sponsored professionals to submit mortgage applications is March 29, while loans must close by June 28, the lender confirmed yesterday. While Rocket will remove sponsorship of licenses, it won't revoke them.

"As we continue to evaluate our business and more precisely focus on the areas of growth for Rocket Mortgage, we made the decision to wind down our relationships with insurance agents, financial advisors, tax professionals and real estate agents who have been originating mortgages on our behalf," said Rocket in a statement.

It's unclear how many mortgage loan originators the program sponsored, or how much volume it produced.

2. Fairway reports cyber attack that exposed customer data nationwide

In early December, Fairway Independent Mortgage fell victim to a cyber attack due to vulnerabilities in a third-party vendor system.

This breach, initially detected on December 4, exposed sensitive customer information, including SSNs, bank account details, and more.

The incident, which affected 430 Massachusetts customers with an undisclosed total nationwide impact, has prompted the company to offer free identity theft protection and credit monitoring to those compromised.

Two law firms, Turke & Strauss LLP and Console & Associates, P.C., have issued notices urging customers impacted to reach out, opening the door for future litigation.

🚨 COACH’S CORNER

I crashed a Tom Ferry Event! Check out why and what I learned! Watch the video here

— Dave Krichmar CEO

3. Liberty Reverse Mortgage sued for violating California labor laws

Liberty Reverse Mortgage is subject to a class action lawsuit filed by former employee Michaela LaNere in Sacramento County Superior Court.

The lawsuit accuses the company of failing to provide mandated rest breaks, meal breaks, and proper overtime compensation in violation of California labor laws.

The lawsuit seeks restitution for lost wages, legal expenses, damages for alleged violations including unpaid overtime and meal/rest break non-compliance, and aims to prevent similar future conduct by the company.

Earlier this week, Liberty's parent company Ocwen Financial Corp., announced a $64M loss in 2023. The parent co, Ocwen, is also facing other legal issues involving the CFPB and FTC over unlawful “convenience“ fees imposed by Ocwen Loan Servicing.

4. Catch up quick

📉 Lowest mortgage rates this week after key inflation data. (MND News)

🗞️ UWM delivers reduced production, improved margins in 2023. (Yahoo Finance)

🏦 Fannie Mae reintroduces a Notice of Potential Defect, allowing lenders a grace period to rectify significant loan issues before repurchase requests. (FHFA)

✍️ As rates rose, mortgage applications for the week ending February 23 decreased 5.6 percent from one week earlier. (MBA)

💸 EasyKnock, a NYC-based home equity solutions platform, secures $28M in Series D funding. (EasyKnock, BusinessWire)

5. FHFA sets timeline for transition to new credit models

The Federal Housing Finance Agency (FHFA) announced yesterday that the transition to new credit score requirements is expected to occur in the fourth quarter of 2025, a decision welcomed by the mortgage industry.

That’s when GSEs will acquire single-family loans based on the FICO 10T and VantageScore 4.0 credit models, replacing the Classic FICO score. The GSEs will also transition from a tri-merge system to a bi-merge system.

“Following extensive stakeholder engagement and input, FHFA is aligning the implementation date of the bi-merge credit reporting requirement with the transition from the Classic FICO credit score model,” the FHFA said in a statement.

The original implementation timeline was for Q1 2024, but it was delayed by concerns expressed by stakeholders and members of Congress.

6. HUD announces new initiatives to boost housing supply and help veterans

$14.5M for veterans

To help homeless veterans and their families find permanent housing, The U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of Veterans Affairs (VA) awarded $14 million in HUD-Veterans Affairs Supportive Housing (HUD-VASH) vouchers to 66 Public Housing Agencies (PHAs) across the country for over 1,400 vouchers.

Please see the list of awardees here.

Boosting supply of manufactured homes

To boost the supply and affordability of manufactured homes, HUD announced $225 million in funding for grants that can be used to replace dilapidated homes; assist homeowners with repairs, upgrades and accessibility modifications; and improve the infrastructure of stormwater systems or other utilities.

The HUD notes that more than 20 million Americans live in manufactured housing, the largest form of unsubsidized affordable housing across the U.S.

🤔 POLL

Honestly, how much do you care — or not care — about AI? |

You’re all caught up. See you on Friday!

Did someone forward you this newsletter? Subscribe here.

Would you like to receive a done-for-you newsletter that you can send to your realtors and/or clients weekly? Go here.

Interested in advertising to mortgage professionals like you? Get in touch.